Oklahoma Fire Department Grants Oklahoma Fire Department Grants FEMA: AFG Program – Fire Prevention & Safety Grant (FY 2017 FP & S Grant) CFDA# 97.044 NOFA: DHS-17-GPD-044-000-98 Due: March 12, 2018 Amount: Max $1,500,000 per applicant. FP&S R&D under Early Career Investigator maximum $75,000 per project year. Eligibility: The following entities are eligible to apply directly to FEMA under this NOFO: 1. Fire Prevention and Safety Activity (FP&S) - Fire departments; and national, regional, state, local, federally recognized tribal, and non-profit organizations that are recognized for their experience and expertise in fire prevention and safety programs and activities. Both private and public non-profit organizations are eligible to apply for funding in this activity. For-profit organizations, federal agencies, and individuals are not eligible to receive an FP&S Grant Award under the FP&S Activity. 2. Firefighter Safety Research and Development Activity (R&D) - National, state, local, federally recognized tribal, and non-profit organizations, such as academic (e.g., universities), public health, occupational health, and injury prevention institutions. Both private and public non-profit organizations are eligible to apply for funding in this activity. Fire departments are not eligible to apply for funding in the R&D Activity. Additionally, for-profit organizations, federal agencies, and individuals are not eligible to receive a grant award under the R&D Activity. Description: The Department of Homeland Security (DHS) Federal Emergency Management Agency’s (FEMA) Grant Programs Directorate is responsible for the implementation and administration of the Assistance to Firefighters Grant (AFG) Program. The Grant Programs Directorate administers the Fire Prevention and Safety (FP&S) Grant Program as part of the AFG Program. The purpose of the FP&S Grant Program is to enhance the safety of the public and firefighters with respect to fire and fire-related hazards by assisting fire prevention programs and supporting firefighter health and safety research and development. In awarding grants, the Administrator of FEMA shall consider the following: • The findings and recommendations of the Technical Evaluation Panel (TEP); • The degree to which an award will reduce deaths, injuries, and property damage by reducing the risks associated with fire-related and other hazards; and • The extent of an applicant’s need for an FP&S Grant and the need to protect the United States as a whole. FP&S Grants are offered to support projects in two activities. This NOFO provides potential eligible applicants with application requirements and details for processing and evaluating applications for financial assistance for both of these activity areas. Fire Prevention and Safety Activity: The FP&S Activity is designed to reach high-risk target groups and mitigate the incidence of death, injuries, and property damage caused by fire and fire-related hazards. Accordingly, the four project categories eligible for funding under this activity are: o Community Risk Reduction; o Code Enforcement/Awareness; o Fire & Arson Investigation; and o National/State/Regional Programs and Studies. Each category within this activity has specific priorities. For additional details, please see Appendix B – Programmatic Information and Priorities, Section III. Funding Priorities. Firefighter Safety Research and Development (R&D) Activity: The R&D Activity is aimed at improving firefighter safety, health, or wellness through research and development that reduces firefighter fatalities and injuries. The six project categories eligible for funding under this activity are: o Clinical Studies; o Technology and Product Development; o Database System Development; o Dissemination and Implementation Research; o Preliminary Studies; and o Early Career Investigator The FY 2017 FP&S Grant Program also plays an important role in the implementation of the National Preparedness System. The National Preparedness System is the instrument the Nation employs to build, sustain, and deliver core capabilities in order to achieve the National Preparedness Goal (Goal) of a secure and resilient Nation. Complex and far-reaching threats and hazards require a collaborative and whole community approach to national preparedness that engages individuals, families, communities, private and nonprofit sectors, faith-based organizations, and all levels of government. The guidance, programs, processes, and systems that support each component of the National Preparedness System allow for the integration of preparedness efforts that build, sustain, and deliver core capabilities and achieve the desired outcomes identified in the Goal while maintaining the civil rights of individuals. The FY 2017 FP&S Grant Program’s allowable costs support efforts to build and sustain core capabilities across the Prevention, Protection, Mitigation, Response, and Recovery mission areas. Examples of tangible outcomes that may be seen for projects funded in FY 2017 FP&S include building and sustaining core capabilities, such as Fire Management and Suppression and Long term Vulnerability Reduction. Additional details on the National Preparedness Goal can be found at https://www.fema.gov/national-preparedness-goal. Link: https://www.fema.gov/welcome-assistance-firefighters-grant-program This information was shared to us by Social Advocate Associates, LLC. For help writing grants you can contact Danielle Sotelo and Ashley Ramsey at

0 Comments

VFIS of Oklahoma is looking to bless 10 Oklahoma heroes and their families this holiday season. We are asking you to nominate a member of your department, or neighboring department, who would benefit from this $100 cash blessing. Please complete the attached application and submit back to [email protected] no later than November 30th or fill out the online form below.

Does your department use the line item "New Business" on your agendas? Do you use it as a header for all the topics that day? Check out our latest video covering the proper way to use "New Business".

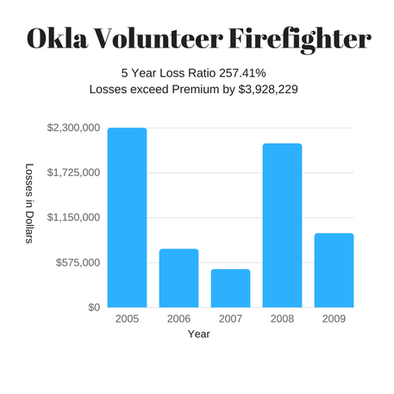

NEW BUSINESS - Any matter not known about or which could not have been reasonably foreseen prior to the time of posting (24 hours prior to meeting). 25 O.S. § 311(A)(9).  Embezzlement in our governmental services across the state is getting more prevalent than ever before. It seems like every month or couple weeks we hear of an outlandish story of theft from within a city or stand alone fire service. Every year I meet with hundreds of departments all across the state. I often get the same story about how the treasurer or board members are long time members and that they would know if ever a dime was missing. Yet every couple weeks the same people or departments pop up with an allegation of embezzlement. I was going to go into a list of ways to embezzle and what all is considered embezzlement. But I have decided to get straight to the point. What is the number one way departments are being taken advantage of? "Manufactured or Prepared Financial Documents and Spreadsheets". You absolutely cannot solely use documents that have been retyped or prepared by a treasurer, clerk or chief. The numbers can be altered for years and know one would ever know, at least for a very long time. It gets even worse when the only person seeing actual bank statements is the person preparing the documents. A recent case involved the board member and the treasurer both conspiring over many years to embezzle an obscene amount of money. They got away with it for so long because these are the only two at this entity that looked at the actual bank statement. When I say bank statement I mean the "bank generated/printed statement". I believe more than 75% of all embezzlement in the state would cease immediately or bring itself to light if every department adopt the very ease simple guidelines. 1. At all board meetings, a current bank generated statement should be presented. If you use a spread sheet or other prepared document. You should also have an attached bank statement to it makes the numbers on the prepared document relevant to reality. 2. One person not authorized to deposit or withdrawal conduct a quick simple monthly audit of the finances. This person should be not directly supervised or connected to the treasurer or clerk. 3. Have two members present anytime cash is changing hands and have two members present when preparing bank deposits involving cash. 4. Two signers an all checks. The presence of actual bank statements in our meetings would be revolutionary. Now this is just one element when it comes to embezzlement. The link below is to a great article on the Firehouse website by Bill Jeneway that has many case studies and additional information on embezzlement and finances in the fire service. 10 Steps for Theft Management in Fire DepartmentsBY WILLIAM JENAWAY ON JUL 8, 2015 Jerrad Van CootsJerrad Van Coots is VFIS of Oklahoma lead specialist. Spending 100% of his time with ESO in Oklahoma.  Long ago Oklahoma's legislators made the decision to provide workers compensation for Oklahoma's volunteer firefighters. There is no need for me to explain the buckets of money saved by cities, counties and the State of Oklahoma due to the daily efforts of volunteer firefighters. Volunteers risk their lives and livelihood of their families to serve their communities. So when it came time to pass the Volunteer Firefighter Workers Compensation (VFWC) bill for volunteer firefighters, it was an easy decision for our lawmakers to make. The main purpose of this article is to illustrate the current environment that the VFWC program is in from my perspective. Originally by Oklahoma statute, CompSource (a state agency), was tasked with administering and processing claims of the VFWC program. Meaning CompSource would receive and process paperwork for signing up departments and then handle the payments of claims when they occur. The State of Oklahoma pays CompSource around $500,000 annually to buy this policy for all uncompensated volunteer firefighters. Even at nearly a half of a million dollars CompSource is willing to walk away from it. Why is this? Its not a stretch to assume the reason CompSource would walk away from this program is due to the losses that they have experienced over the last decade. In 2011, the last published documentation that we have been able to find shows a 5 year loss ratio of 257% or $3,928,000. These losses were calculated from 2005 to 2009. So for every $1.00 CompSource took in, it paid out $2.57. From 2009 to 2016 medical care in Oklahoma has increased every year between 3% and 7%. But the State’s payment of $500,000 has stayed relatively the same, as the losses continue to rise. To add insult to injury, in 2014 legislators passed HB 2201 creating CompSource Mutual. Beginning January 1, 2015, CompSource Mutual was no longer a state agency but now a private company. But there was one string still tying the State to CompSource. You guessed it, the VFWC program. But why should a private company be tied to the State of Oklahoma by statute? This question has been floating around for sometime between the state and CompSource Mutual. How and when to break the tie has been hard to nail down. Why is that? Our state is once again in revenue failure. Anything that could cost the state more money is out of the question. At $500,000 no other company would take on this program for such a low amount. So what should the state do? You could try and do what Senator Shaw has proposed this year in SB159. He is proposing that the state bid out the insurance program and double the premium to nearly $900,000. This sounds like a great idea but even at the loss ratio's from the 2005-2009 study a million dollars would still not be enough to cover the losses. To an insurance company this program is like holding a live grenade that will blow up every year. If this program ends up year after year bouncing between different insurance companies, there could be a good chance that year after year the premium payment will increase depending on losses. I know we have painted a bleak picture here, so what should we be thinking going forward to try to fix this. First things first, the State of Oklahoma didn't decide to pay a set amount for workers compensation for volunteer firefighters. What they did decide was that coverage for workers compensation should be provided. The volunteer fire service cannot go forward and take for granted its free workers compensation. We must look at it like we look at our own personal insurance. If you abuse your insurance with tons of claims, we all know your rates will go up. When claims go up; then rates go up. The VFWC program is like a delicate baby bird. We have to take care of it and communicate to others how to handle it. To put that same bird into todays situation would be like throwing it up against a wall repeatedly. Guess what? It’s going to die. Injury prevention and safe operating practices should be a daily topic. Through personal experience as a safety coordinator with a large corporation, injury prevention awareness can have a profound effect on lowering the rate of injuries. A formal injury prevention awareness program could help our volunteers chances to sustain free workers compensation in Oklahoma. I think we are on the edge of a significant increase in claims due to the increased call volumes and exposures that EMRA’s are about to be faced with. Drivers training programs are not enough. Your service should include courses like Patient Handling if you’re running first responder. Even raising awareness for slip, trip and fall accidents would beneficial. Oklahoma had a fair share of significate injuries from slip, trip and fall claims in 2016. I will leave you with this. Most volunteer fire departments in the US pay for workers compensation out of their departments budget. I can count only a few that have state ran programs like Oklahoma . Most of these states have vastly diminished coverage and still have to buy a supplement to make up the difference in coverage. Senate Bill 159 passed the appropriations committee on February 22nd. Breaking the tie with CompSource Mutual is inevitable and it will be up to the fire service to get into the right mind frame to sustain it. Links: SB159 Interim Study Jerrad Van CootsJerrad Van Coots is VFIS of Oklahoma's lead specialist. Spending 100% of his time working with Oklahoma's emergency services.  Oklahoma has made significant strides in advancing the administration of our fire departments. Year after year, we see some form of education or clarity make its way into these administrative roles creating consistency. This year the focus seems to be on the relationship with county purchasing and the distribution of “fire” sales tax money collected on a county wide basis. Before this last legislative session, Oklahoma State Statute did not include the language it needed to properly address the process of distributing levied sales taxes to non-county employees via purchase orders. HB2360 authored by Representative Rousselot addresses these issues by including new statute language allowing, “two individuals who are not county employees to act as receiving and requisitioning officers”. Additional language was added stating that, “any non-employee of the county designated… shall provide evidence of an employee dishonesty bond”; this was done to mirror the bond requirement for county employees . So what do we need to know? This first thing to understand is that HB2360 didn’t change anything, it actually added additional options. Before requisition officers and receiving agents should only have been county employees, now they can be non-county employees. This creates two options to choose from. In our state every county is run different from the next. These decisions will end up being different for many of you depending on how your county has historically operated and the individual decision made county by county. What to ConsiderDoes your department want a county employee (Clerk, Emergency Manager) to act as the receiving or requisition officer for our department? There are a couple of counties in Oklahoma that have operated in this fashion. For these counties there is nothing to do because they fit into the existing statute of a “county employee” who is currently bonded as a county employee. There is one major drawback in this arrangement outside of the co-mingling of interests of the county in the departments. The drawback is what is at the root of bonding. It should be protecting the interest of the county sales tax. Employee dishonesty bonds will repay monies lost in the dishonest acts of a “covered/bonded” individual. Dishonest acts can be considered any act where an individual uses money or property for personal financial gain. So for example, if your department choses to name the Clerk as your requisition officer and receiving agent, then your department purchases radios with the county sales tax money. The assistant chief pawns those radios 2 months later and keeps the monies for himself. Your bonding of the Clerk will do nothing to repay the monies embezzled by the assistant chief. Regardless if you choose to name the Clerk or any other county employee, your department should still consider bonding its Fire Department employees/volunteers as well.

Does your department want to name a department member as the requisition and/or receiving officer? The majority of departments have chosen this route in defining their relationship with the county. This is where HB2360 comes into play. It allows you to name two individuals to act as the requisition officer and receiving agent in your departments. Now all you have to do is see that they are bonded to meet the requirement in naming individuals not employed by the county. This is your best option for many reasons. The person bonded will be a department member and dishonesty coverage will apply to those individuals. Also bonds can extend out to other individuals and or positions providing coverage for them as well. How much of a bond do we need? Historically, statues like this should be accompanied with a mechanism to determine the limit of the bond. Since HB2360 does not contain this information department need to use sound judgement in setting these limits. It is suggested that the bond limit should be set to be 12 months of levied taxes. So if you receive 2,000 a month on average, then a $24,000 bond would essentially provide the coverage your department needs for the theft exposure. Who should be bonded? HB2360 by statute mandates that if you have a Requisition Officer or a Receiving Officer apart of your service then they should be bonded. In Oklahoma State Statute Title 19 it stated that treasurers of County Fire Services and Fire Protection Districts shall bond their treasurers for how much money comes in and out of their hands and conditioned to faithful performance. As you can see below only Title 18 departments in a county not receiving tax money are the only fire services not required to be bonded. Required by Statute - Receiving County Tax Money Title 11 101 City Municipal 1. Receiving Officer 2. Requisition Officer 3.Clerk (Already Bonded) Title 19.351 County Fire Service 1. Receiving Officer 2. Requisition Officer 3. Treasurer Title 19.901 Fire Protection Districts 1. Receiving Officer 2. Requisition Officer 3. Treasurer Title 18.593 Volunteer Fire Associations 1. Receiving Officer 2. Requisition Officer Required by Statute - Not Receiving County Tax Money Title 11.101 City Municipal 1. Clerk (Already Bonded) Title 19.351 County Fire Service 1. Treasurer Title 19.901 Fire Protection Districts 1. Treasurer Title 18.593 Volunteer Fire Associations - NOT REQUIRED How to get bonded? Getting a bond is a quick and easy process. Costs for bonding are between $117 for a $10,000 bond and $370 for a $100,000 bond covering up to 5 positions. These figures are estimated as every company has different rates and coverage. Many insurance agencies across the state do bonds for different industries. If you choose a local agency to handle your bonds, be sure they have a working knowledge of the fire service and the current statues that shape how your bonds should be issued and the language of the bond fits the statute. VFIS of Oklahoma has spent several months constructing the best possible bonding program for Oklahoma. We have special authority to instantly produce a bond for your service and the total process takes less than 5 minutes by phone. We currently write hundreds of bonds in just about every county and have many bonds that have been in place for over 30 years. You’ll find no other that will work harder for you and your service. Jerrad Van Coots VFIS of Oklahoma Original Article can be found here OSFA |

AuthorJerrad Van Coots is VFIS of Oklahoma lead specialist. Spending 100% of his time working for Oklahoma's Emergency Services. Archives

January 2018

Categories |

IMPORTANT NOTE: This Web site provides only a simplified description of coverages and is not a statement of contract. Coverage may not apply in all states. For complete details of coverages, conditions, limits and losses not covered, be sure to read the policy, including all endorsements, or prospectus, if applicable. Coverage CANNOT be bound, amended, or altered by leaving a message on, or relying upon, information in this Website or through E-Mail.

RSS Feed

RSS Feed